Buying a house may be no easy feat, but it’s one of the most rewarding achievements anyone can aspire to. A home in a dynamic and exciting city like Toronto is an even more worthy goal, at least in our opinion!

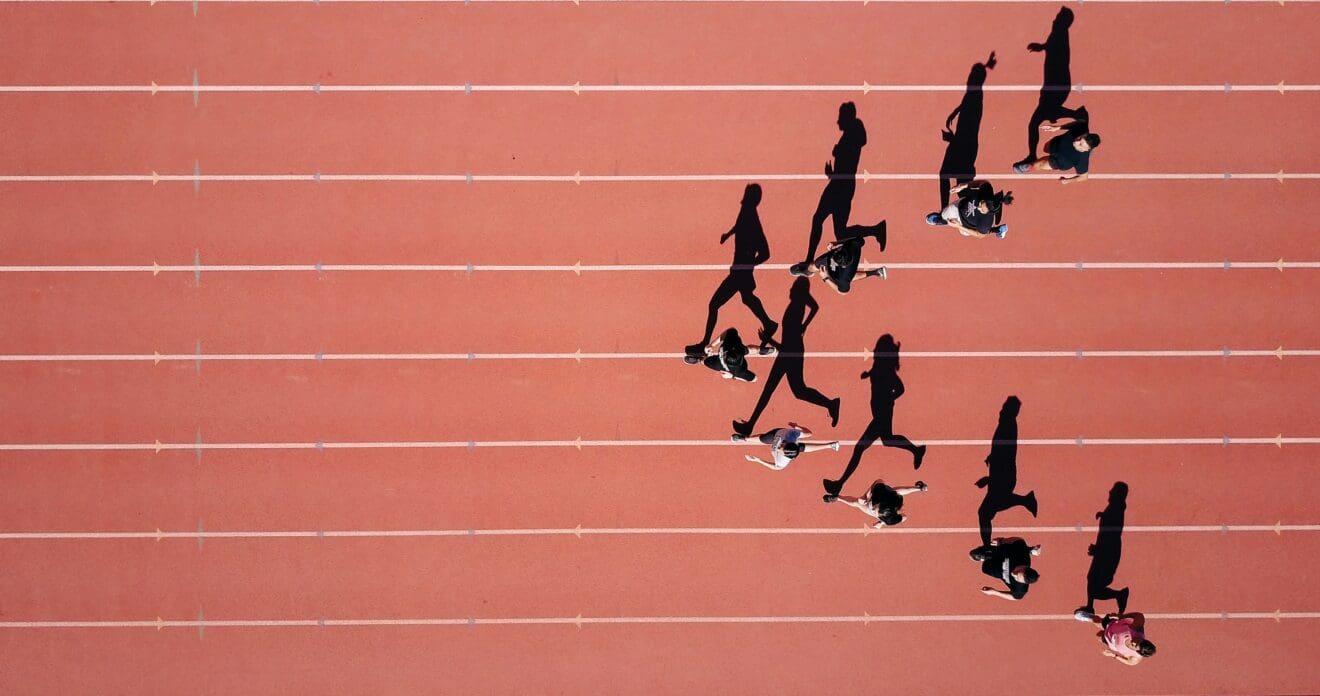

The route to homeownership can seem long and winding, but with a plan, anything is possible. One of our primary goals has always been to help people buy their first house as soon as it is financially feasible and they are ready for the milestone.

If homeownership is on your mind, here are a few strategies to put you on the express lane to achieve it.

Do you want to use every tool at your disposal to make your first home-buying experience a success? Then don’t miss our free guide, Top 10 Mistakes Buyers Make—And How to Avoid Them. Download your copy for free right here.

Choose Your Representation

You could start out on your journey on your own. But with so many incredible resources available to you, why would you? If you really want to be in the fast lane to success, a real estate agent who is just as enthusiastic about your goal is a partner you don’t want to be without.

A skilled agent will be there through thick and thin to guide you through all aspects of your transaction. You’ll have proven strategies aligned with the current market to ensure you get the right home at a fair price and terms.

There’s also nothing like having an expert who truly cares and is there whenever you need advice and support throughout this process. If you’re in the beginning stages, it doesn’t hurt to start the conversation early.

When buying a home, one of your first decisions is where you want to live. The posts below could help you narrow it down:

- West End Vs East End: Which One Wins in Toronto?

- Up and Coming Neighbourhoods for Families

- Top Dog-Friendly Neighbourhoods in the West End

Work Out the Math

Many people freeze when they hear the words “arithmetic” or “math.” However, working out a budget is one of the best ways to get on the fast track to buying your first home. You’ll know what type of house you can afford comfortably, as well as how much you will need for a down payment, closing costs, and to cover your monthly mortgage.

Knowing your numbers in advance will save you time and heartache by not visiting homes outside of your price range. A written pre-approval will help you make a positive impression on sellers, who will be more receptive to your offer. Plus, you’ll be able to lock in the lowest interest rates between when you get your Certificate of Pre-Approval and when you make your purchase.

Down Payment and Closing Costs

Home prices in Toronto range, and you can calculate your down payment and estimated closing costs accordingly. The down payment is based on a tiered percentage according to the following:

- 5% on the first $500,000

- 10% on the amount from $500,000 to $1.5 million

- 20% on any amount over $1.5 million

Imagine you’re buying a home or condo worth $750,000. You can expect to pay $50,000 (5% of $500,000 plus 10% of the remaining $250,000) of your own money while your mortgage lender covers the rest.

The deposit is the portion of your down payment you submit within 24 hours of the seller accepting your offer. The amount is negotiable, but it’s typically 5% of the total price rather than the tiered amount.

Closing costs consist of land transfer taxes, both municipal and provincial. You’ll also need to cover legal fees, home inspection costs, title insurance, and utility hookups. It’s hard to pinpoint an exact number, but ideally, you’ll have 2.5% to 4% of the total purchase price.

If you’re feeling overwhelmed, remember that there are several government programs available just for first-time buyers. To see how these can make your home purchase more accessible, check out our post How the Government Is Helping First-Time Buyers in Toronto.

Map Out Your Search Strategy

With the math and market research out of the way, you’re ready to move on to the most exciting part of this process by far: your house search! You can browse online to get an idea of what you’re looking for and to start making your wish list.

However, nothing beats getting out there and seeing homes in person. It’s not unheard of to not “like” a house from the online images but fall in love the minute you see it in real life. The opposite could also be true; the home might have everything you think you want on paper but leave you underwhelmed when you actually walk through.

With each listing that doesn’t work out, we fine-tune your vision and begin to come up with better matches based on your evolving preferences.

Offers and Negotiation

Once you’ve found a house you love, it’s time to get down to business. You’ll make an offer, and the seller will respond by accepting, declining, or counter-offering. Your negotiation power will depend to a large extent on the market but also on the skill of your real estate agent.

Our top priority is always to get you the best possible deal in terms of the price, closing date, any conditions, and the deposit. This requires a significant amount of research into the market and comparable properties that you are considering.

We’ll factor in the selling history, what other properties are available, and whether or not there are competing bids. All of this allows you to rest assured that you have received the best possible value in the market today.

We have too many tips for Toronto home buyers for a single blog post. To learn even more, check out the resources below:

- Five Real Estate Myths: Busted!

- How To Find the Right Real Estate Agent

- What Is Fractional Ownership in Toronto?

The Closing Process

If you’ve made an offer and the seller accepts, it’s on to the closing process. You may be eager to get your keys and move in, but there are a few details to tend to first. Within 24 hours, you’ll make a deposit that will be held in trust until closing.

There will be a conditional period if the offer is conditional to give both you and the seller time to fulfill all terms of the deal. This may involve arranging for financing and a home inspection to ensure all of your bases are covered.

Finally, a real estate lawyer is essential. They will examine all of the paperwork to make sure it’s legally sound, perform a title search, and arrange for title insurance on your behalf. As your closing date arrives, you’ll be able to book a final walkthrough, which is a great time to measure for that new furniture you’ve always wanted!

Upon your closing date, you’ll submit the rest of your down payment and your lender will finalize your mortgage. Soon, you’ll get the keys, and your dream of owning your home will become a reality.

Your ideal home is out there waiting just for you, and we can’t wait to help you find it. Reach out to us at erica@ericareddy.com or call 416.443.0300, and we are happy to answer any questions about the process.

Meet The Erica Reddy Team

Find out how our specialized skill sets and extensive Toronto market expertise empower your real estate venture.